OVERVIEW

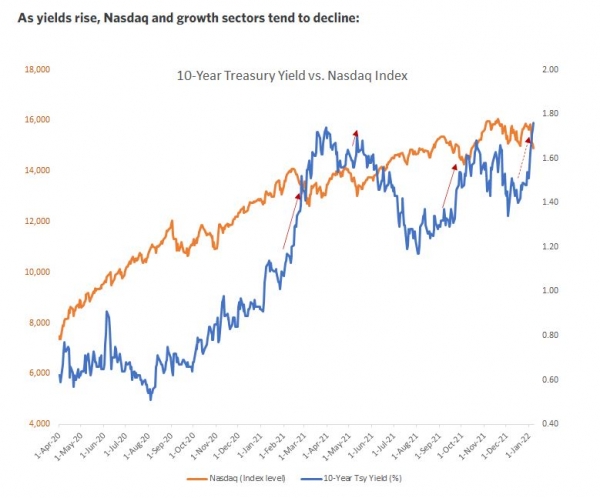

Markets started 2022 with a bit of a bang for investors. Equities and bonds fell in tandem on the back of Fed minutes which turned out to be more hawkish than expected, leading to US 10-year bond yields to break critical levels. These minutes indicated that the Fed was not only considering raising rates and accelerating its balance-sheet tapering process, but also letting the balance sheet rollover and decline sooner than most expected. This potential reduction of liquidity spooked markets, particularly those areas with loftier valuations, as there seemed to be less appetite for speculative assets in the new environment.

Despite a potentially less supportive liquidity outlook in the months ahead, current signals lead us to maintain a positive stance on risk assets and equity in particular. Global growth remains above potential, financial conditions remain supportive, global earnings growth remains well oriented and some segments of the market remain reasonably valued. Last but not least, our market technical indicators (trend, sentiment, etc.) continue to be positively oriented.

In a nutshell:

- We maintain a positive view on equity markets coming into 2022. However, we also expect equity returns to be more moderate than last year, and volatility to increase to more normal levels – and we already got a taste of both in the first week of 2022.

- We continue to favor developed markets over emerging markets. However, we are upgrading China equities from cautious to positive on the back of superior earnings growth expectations, attractive valuations and on improving monetary policy conditions in mainland China.

- From a tactical standpoint, we are turning less negative on aggregate fixed income. Indeed, we decided to reverse last month’s timely move as the upward risk on rates is now less important. We maintain our disinclination on Government bonds due to the Fed’s policy reassessment. However, we believe the scope of further yield curve steepening is limited as the Fed’s normalization is already priced in. We are turning more cautious on the EUR curve given ECB inflation concerns and potential normalization to come.

- While we were bullish on the dollar throughout 2021, we now believe that the greenback is forming a top and that the EUR, GBP and JPY have some upside potential.

- We remain cautious on commodities. Our tactical asset allocation is summarized in the matrix at the end of the article.

INDICATOR #1

MACRO ECONOMIC CYCLE: POSITIVE (unchanged)

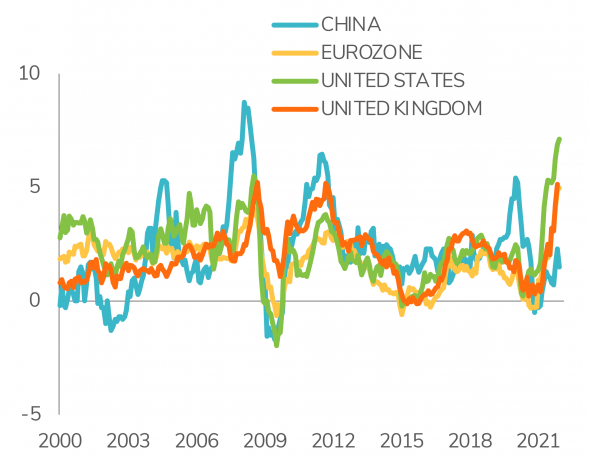

Global growth remains firmly positive and will stabilize at an elevated level in 2022. Manufacturing activity is also stabilizing at an elevated level in DM. Service sector activity remains generally strong. The US economy is entering 2022 with very strong momentum and red-hot consumer spending. Covid restrictions are affecting some European countries. In China, growth momentum is picking up as monetary policy easing supports economic activity. When it comes to economic surprises, they are neutral in the US and positive in Europe and China. Inflation is rising further above central bank targets across DM and even picking up in Asia. While inflation keeps rising in developed markets and continues to exceed expectations (especially in Europe), we note that medium-term expectations is for inflation to stabilize as central banks move toward tightening.

INDICATOR #2

LIQUIDITY: NEUTRAL (unchanged)

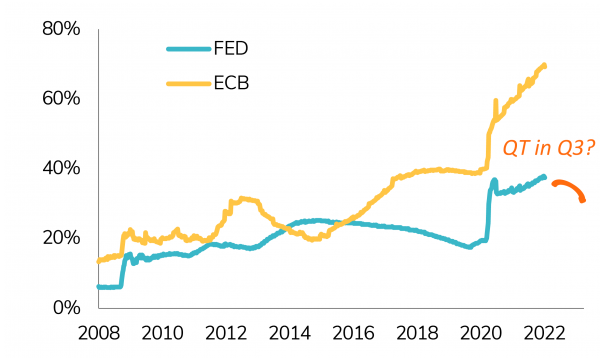

Monetary policy remains very accommodative across the board, including now in China with the recent easing in financing conditions. That being said, inflation dynamics in the US lead the Fed to jump on the brakes. Federal Reserve minutes from its December 2021 meeting were released last week and indicated that the Fed was not only considering accelerating its balance-sheet tapering process, but also letting the balance sheet rollover and decline sooner than most expected. With full employment, strong economic growth and rising inflation, the Fed has indeed every reason to normalize its monetary policy rapidly. We are thus cognizant that global liquidity may soon stop growing as the Fed aims to end QE by March 2022 and considers Quantitative Tightening (QT). Overall, we keep a NEUTRAL stance on liquidity as global financial conditions (low interest rates, still expanding central bank balance sheet, tight credit spreads) remain supportive. It is the second derivative (i.e rate of change, especially in the US) which is turning negative.

INDICATOR #3

EARNINGS GROWTH: POSITIVE (unchanged)

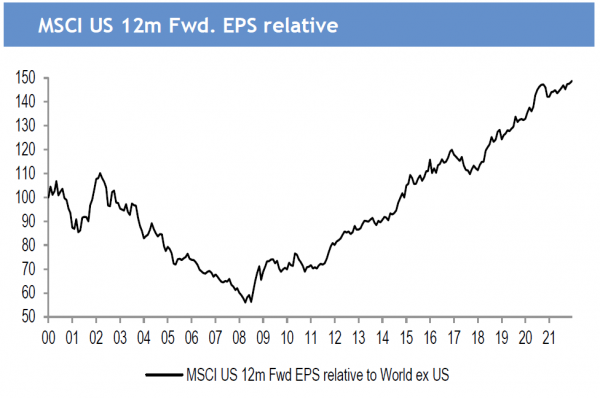

US equities have sharply outperformed the rest of the world over the last few years on the back of strong US earnings growth and record high margins. This year, we still expect robust US EPS growth. However, the growth differential between the US and the rest of the world may start narrowing. Overall, we note earnings growth expectations for 2022e seem reasonable in most regions. While top-line growth is expected to decelerate and operating margins hover around record levels, decent global economic growth, share buybacks and productivity gains leave room for some upside surprises.

INDICATOR #4

VALUATIONS: NEUTRAL (unchanged)

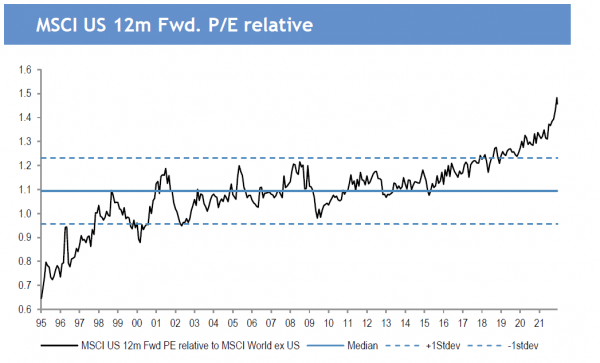

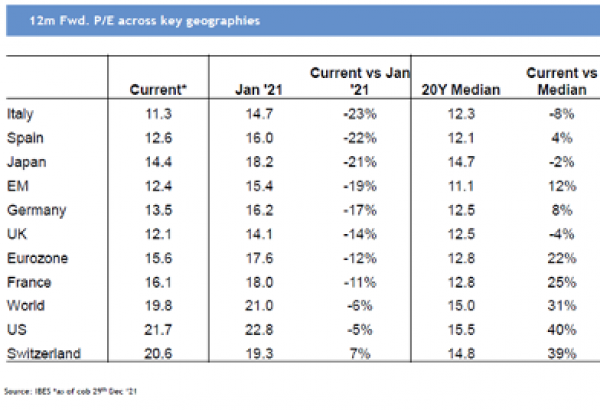

While equity markets – especially developed ones – are not cheap, we note that equity P/E multiples de-rated in 2021. We may see another year of benign multiple compression offset by decent earnings growth. From a relative standpoint, equity market should remain supported, as the earnings yield minus bond yield gap remains attractive. From a regional perspective, US equity markets continue to trade at a large premium vs. the rest of the world. This can be somewhat justified by an investment style bias (much higher exposure to growth vs. value than in other regions). European equity markets look fairly valued while the equity risk premium in the UK is still attractive. We also note that valuation ratios have been improving in Japan.

INDICATOR #5

MARKET TECHNICALS: POSITIVE (Upgrade)

At the time of our writing, the vast majority of our proprietary technical indicators (technical, volume, sentiment, trends and breadth) offer a rather positive picture. Equity markets are not overbought anymore and sentiment indicators are not exhibiting signs of complacency. The trend remains upward although the rate of change (low frequency indicator) is not as positive as it was in 2020-2021. The volume indicator is giving a negative signal but this is mostly explained by a seasonality dimension (low volume around year-end). The market breadth indicator is still negative but has shown some improvement recently. The low frequency / long-term indicators continue to indicate that the long-term bull trend (price above 200 days moving average) still holds.

ASSET CLASS PREFERENCES

EQUITY ALLOCATION

Positive

For the coming month, we are maintaining a positive bias toward equity allocation. In the current environment of positive economic growth and negative real bond yields, equities remain clearly the most attractive asset class. From a regional point of view, we continue to maintain a preference for Eurozone equities. Earnings growth is strong and valuations are in-line with the historical average. Meanwhile, the Eurozone earnings base is still below pre Global Financial Crisis highs, which is mainly accounted for by domestic sectors. We also have a preference for Japan on the basis of 1) Strong operational leverage (high sensitivity to growth); 2) Record cheap valuations; 3) Improving macroeconomic growth and; 4) New political leadership. We are positive on US equities. Valuations are high, but the Return on Equity is on aggregate above the rest of the world. From a sectorial standpoint, we continue to maintain a long-term preference for a secular growth story in addition to some tactical exposure to value / cyclical names. Indeed, while the later are more attractively valued and are benefiting from the steepening of the curve, the recent pullback of growth names (especially in the small & mid-caps segment) may actually offer investors the opportunity to add to growth and technology sectors. The risk- reward at these price levels seems interesting and even more compelling if the sell-off continues in the near-term. While we continue to favor developed markets over emerging markets, we are upgrading China equities from cautious to positive on the back of superior earnings growth expectations, attractive valuations and on improving monetary policy conditions in mainland China.

FIXED INCOME ALLOCATION

Tactically upgrading rates exposure

From a tactical standpoint, we are turning less negative on aggregate fixed income. Indeed, a sharp upward movement in yield curves just took place, driven by real yields. We are reversing last month’s timely move as the upward risk on rates is now less important. We believe that long-term inflation expectations should stabilize with prospects of monetary policy tightening. We maintain our disinclination on Government bonds due to the Fed’s policy reassessment. That said, we believe the scope of further yield curve steepening is limited, as the Fed’s normalization is already priced in. We are turning more cautious on the EUR curve given ECB inflation concerns and potential normalization to come. We stay cautious on all the credit spectrum due to valuation but would consider a sell-off in US High Yield as a buying opportunity. We remain positive on subordinated debt. The segment looks mature and resilient and continues to offer some premiums while the current environment is still favorable to banks. We remain positive on Emerging Markets debt as the sell-off is offering more attractive valuation. We continue to like Asian High Yield as opportunities abound during the current sell- off. Chinese CNY bonds look attractive in the current context.

COMMODITIES

Still cautious

We remain cautious on commodities. While the asset class recorded in 2021 its best year since the oil crash in 1973, we believe the recent bull run is overbought and somewhat driven by panic rather than pure fundamentals. We keep an exposure to Gold. The upside of the yellow metal still depends on how much lower US real rates can go. But it was encouraging to finally see some firming recently as investors are looking for some diversifiers in their multi-asset portfolios.

FOREX

Turning positive on the euro, sterling and Japanese yen against dollar

While we were bullish on the dollar throughout 2021, we now believe that the greenback is forming a top and that the EUR, GBP and JPY have some upside potential. Macroeconomic momentum is turning in favor of the EUR vs USD. The trigger for an upward move in EUR/USD could be the ECB starting to guide toward normalization as the Fed has done a few months ago. The beginning of the BoE rate hike cycle may have created a floor for the GBP. Growth momentum differential has turned clearly in favor of the Yen recently.

Tactical Positioning: Our Asset Allocation Matrix

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

Related Articles

The global growth cycle hit its lowest point in 2023 and is now picking up. Earnings estimates have been creeping higher. Although central banks are hesitant to lower interest rates at this moment, they are conveying more accommodative signals to the market, which maintains the prevailing "risk-on" sentiment.

US economy rebounds with robust job creation and wage growth. Risk assets soar with the S&P 500 hitting historic highs and Japan's Nikkei 225 at a 34-year peak. Our diversified strategy pays off; adjusting Switzerland and Emerging Markets in equities, upgrading GBP yield curve in fixed income, and tweaking forex positions.

We expect the US & global economy to cool down in the months to come, leading to a Fed pause. This would be a positive for equity and bond markets over time.

.png)