The prospect of effective vaccines is improving rapidly. Assuming that supply chain issues can be resolved and scaled, we can expect to see a treatment rolled out to vulnerable and key populations, and then the wider public, over the coming months. An economic return to pre-pandemic levels of activity depends on the widespread use of successful vaccines. At the time of going to print, many countries were living through a second phase of social lockdowns, protecting public health systems while damaging economic activity.

2021 MARKET OUTLOOK - No vaccine for low growth

Tuesday, 12/08/2020After an extraordinary 2020, on so many levels, many investors can’t wait to put the year behind us. The US election, for all its noise, has not really changed the fundamental investment landscape. The world’s economies continue to be dominated by the challenges of the Covid-19 pandemic, progress with vaccines and long-term sluggish growth in an environment of low inflation and low interest rates. These themes will continue to color investing throughout 2021.

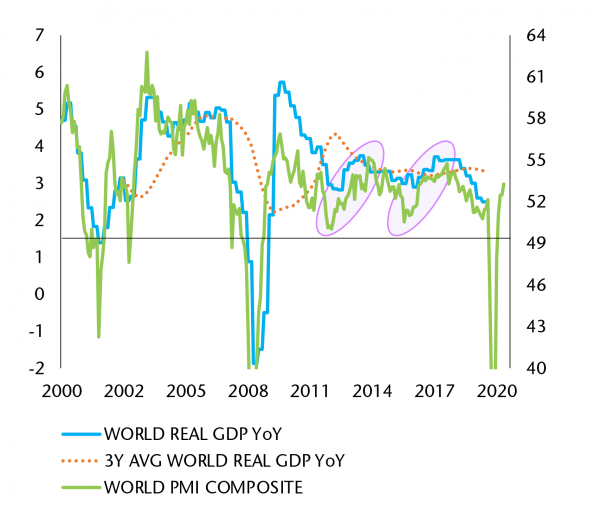

Sadly, there is no vaccine on the horizon for low economic growth. Extraordinary levels of government spending and asset buying from the world’s central banks has cushioned the very worst impacts of the virus on markets and our economies, but it is not enough to jump-start more profound growth. For now, the European Union and China are separately committed to multi-year spending programs, while in the US, the scale of an eventual recovery package will depend on the political makeup of Congress.

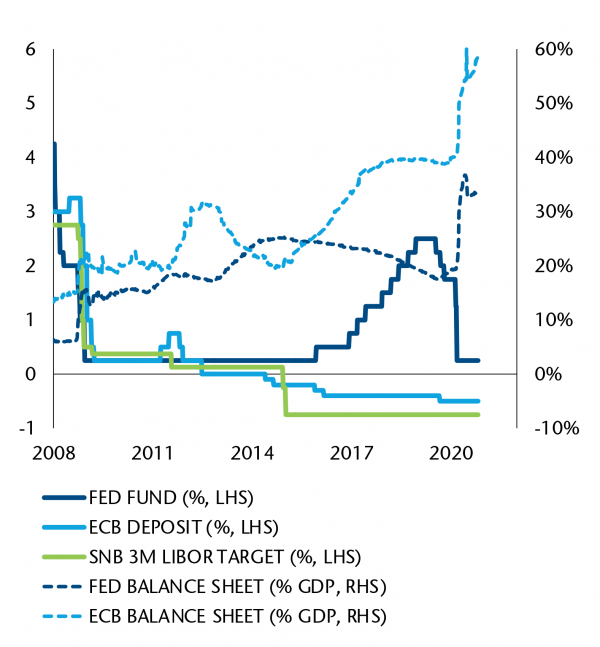

Unless governments spend even more on fiscal stimulus, central banks will not take their feet off the accelerator. Particularly in the light of the experience post-2008, policy makers will be reluctant to try to ‘normalise’ interest rates too quickly. The European Central Bank is committed to purchase public and private bonds for the years to come. In the US, a divided Congress would put more reliance on the Federal Reserve to increase support and keep interest rates low for even longer. There is little reason to suppose then, absent a policy mistake, that any major economy will see a tightening in the currently ultra-accommodative financial conditions.

For a structural economic shift to take place reviving long-term trend growth, we would need to see a combination of wide and effective Covid-19 vaccine acceptance with a sustained additional increase in fiscal stimulus, coordinated with monetary policy and structural reforms. This has been tried in Japan, but the ‘Abenomics’ experience has shown that fiscal and monetary policy only have a short-term impact. The effects fade if not complemented by structural reforms to spur trend growth.

Unfortunately, the political situation in the US and Europe currently leaves little hope for a consensus on such structural reforms. Fiscal and monetary policy are likely to remain the main policy tools, offering short-term fixes to keep economies afloat without altering the long-term trend of lower growth.

For now, policy makers including the European Central Bank and Swiss National Bank, have no catalyst on the horizon to change their accommodative approaches, and so should leave interest rate policies and their asset purchase programs in place for the foreseeable future.

On the multilateral front, US tensions with China under a Biden presidency should ease with lower tariffs, although the underlying competition between the two will remain. This should provide a more trade-friendly global business climate. It should also reinforce China’s recovery, which along with the rest of east Asia, has been faster to return to 2019’s activity levels in the wake of the pandemic than elsewhere. We will continue to see China’s transition to a domestically-driven economy, with the renminbi appreciating accordingly. That should nevertheless prove positive for both emerging markets, and commodities.

In purely political terms, 2021 holds a couple of key events. Among major economies, Germany faces elections with Chancellor Angela Merkel set to step down in October 2021 and Japan must hold a general election. The realities and potential disruptions of the UK’s post-Brexit relations with the European Union will also begin to play out.

Staying invested, staying tactical

- If anyone needed reminding, 2020 was another illustration of the importance of staying invested. Looking ahead, the single greatest unknown is when we will be able to say that the Covid pandemic is behind us. Even an effective vaccine seems unlikely to return us to the same forms of normality as pre-pandemic. After months of lockdowns and social distancing there will be no quick return to normality, meaning the exceptional levels of fiscal and monetary stimulus will stay in place, offering support to asset classes.

While we expect to see a number of sectors recover much of the ground lost in 2020 to the pandemic, we do not anticipate a reversal. Concretely, that means that while energy stocks, for example, may gain and information technology slow, the broader trends will stay in place. Our positioning means that we are able to balance a mix of assets with hedged positions and specific performance drivers to deliver returns.

Over the coming quarters a vaccine may trigger a fuller economic rebound, and that will dominate market sentiment in the first few months of 2021. Nevertheless, while there is a rotation back into sectors that suffered the most under the pandemic, a gradual return to fully functioning economies is likely to leave sectors such as energy, finance, travel and tourism underperforming. This is in part because many of the changes in the pandemic are likely to prove lasting. Consumers will probably keep their online spending habits and the energy sector still faces the challenge of building more sustainable, long-term business models.

If the first key takeaway from 2020 is stay invested, the second lesson from the year is that timing market investments with tactical allocation movements is a key performance driver. Volatile markets create opportunities to add value and performance, so the ability to contain drawdowns and to participate in any upside is vital. The sustained volatility of 2020 will, in all likelihood, extend into 2021.

We are already seeing that news of a reliable vaccine can create rebounds in vulnerable industries, but those that have most suffered are far from recovering to their pre-pandemic levels. And some industries, especially those most disrupted by the lockdowns such as the retail switch to online sales, will not go back to their early 2020 business models. In many sectors, the pandemic has acted as a catalyst, or accelerator of existing trends.

Once the impact of the pandemic diminishes and governments begin to unwind their fiscal support to economies, we will return to the pre-pandemic world of insipid growth. In the short term, we recommend that investors remain committed to keeping equity exposures, despite volatile phases, to generate returns. In addition, selective credit exposure, such as emerging market debt also makes sense. We have also cut back on US high yield credit where we may see more defaults going forward. To manage volatility, we believe that convertible bonds and an exposure to gold continue to play a portfolio role.

Differentiating markets, catching up

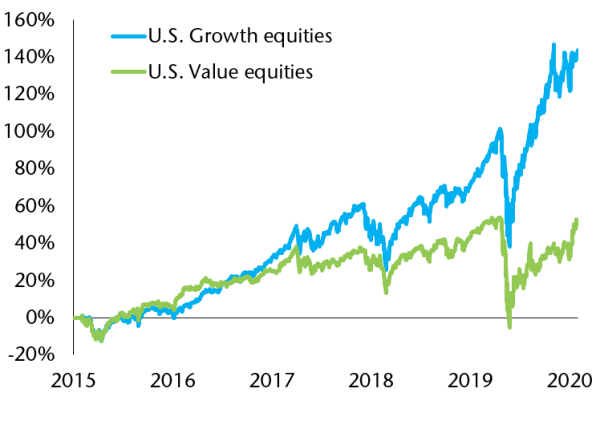

- The global pandemic drove a wedge between equity sectors, starkly separating winners from losers. The technology and online retail sectors outperformed during the pandemic, as working from home and e-commerce accelerated demand for these firms.

November’s announcements of effective vaccines from Pfizer, Moderna and AstraZeneca prompted other lagging ‘value’ sectors such as energy, banks, travel and leisure to begin to catch up as investors saw the first indications that economies could return to their pre-Covid-19 levels of activity. There is a strong case for a catch-up by these severely punished sectors. However, a dependable recovery in these stocks depends on rapid distribution of vaccines to allow a gradual return to normality in 2021. As a result we see selective value here, but several companies will struggle, or may never recover, to their pre-pandemic levels. In the meantime, we believe that technology leaders should continue to benefit from the tailwinds of an increasingly digitalized economy.

2021 will continue to see Chinese markets playing a more important role in investors’ portfolios. Chinese equity markets are attractive given their strong underlying macro momentum and the prospects for domestic earnings growth. Despite the strong performance posted in mid-2020, there is still a solid upside in the coming years. China’s fiscal and monetary policies provide a solid support to domestic equities. One risk where investors will be on guard is the threat of regulatory challenges to the technology industries, in both the US where there is a possible antitrust case, and as we saw in November, to China with discussions about fair competition. New regulation in the US or China would certainly generate volatility, which could be far-reaching for markets given the share of technology firms in indices.

A second reason to pay attention to China is that the pandemic has underlined that US, European and Chinese equity markets, reflecting their economies, are uncorrelated, and so offers opportunities to diversify. This justifies a structural allocation to Chinese equities in portfolios.

Selectively adding performance

- The global pandemic has accelerated the existing digitalisation trend. Coupled with globalisation and ageing populations in western countries, this should help to keep inflation low.

To limit the negative impacts of the pandemic, almost all central banks have adopted accommodative monetary policies, keeping rates and inflation low in 2021. Nevertheless, in the short-term, we expect a slight growth and acceleration of inflation, or reflation, as vaccines boost expectations for economic activity. Once past, we anticipate a return to a path of low growth and sluggish inflation.

While we do not see this dynamic altering the fixed income landscape, there is no hiding from the fact that this is a demanding environment for investors.

Since the first round of lockdowns in March almost eliminated the amount of negative-yielding credit on the market, the share has been rising again, and around one quarter of the sovereign market offers negative yields. As a result, only active approaches can generate returns.

Long sovereign bonds continue to play a role in every portfolio because they provide liquidity and can help to compensate for the risks run in falling equity markets. Investment grade credit, which mostly consists of good quality issuers, can provide interesting returns. This segment is less attractive than the second quarter of 2020, but still offers value. The same is true as far as ‘BBB’-rated investment-grade credit, where the issuers are robust enough to survive and then thrive post-pandemic. Selectivity will remain key to investing in this segment.

Corporate refinancing has been widespread and companies have extended their average credit maturity. Consequently, even if the total level of debt has risen, the cost of servicing debt is often lower – and the visibility to investors is higher. For this reason, we do not foresee broad derating in the investment grade credit segment.

Further down the credit quality scale on the other hand, default rates will rise as a direct result of the pandemic. That is happening fastest in the worst-hit sectors, such as travel and tourism. We are therefore wary of high yield credit at this stage of the recovery, and instead prefer exposure to investment grade and dollar-denominated emerging market bonds.

We also believe that convertible bonds in this environment remain a useful tool, with options priced at historically interesting levels. Convertible bonds are a proven instrument, but are often underrepresented in private client portfolios because they look complex. This is unfortunate as it misses their convexity, which means they can cushion a portfolio loss in equities, while capturing a large part of any gain in stock markets.

Finally, 2020 offered a stress test of the green bond market. Many companies chose to issue these instruments, pushing the value of new issues by one third to around USD 300 billion while supporting the global efforts to address the effects of climate change. We also saw a growing awareness in the market that it makes more sense to invest in transitioning industries that are working to develop carbon-neutral solutions, rather than already-sustainable businesses. Green bonds are beginning to attract a premium, quite simply because investors appear ready to pay a little more for an instrument that contributes to sustainable solutions.

Investing in an attractive vintage

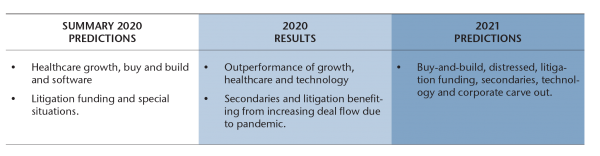

- One of the stand-outs from this year’s pandemic is that, given the extraordinary levels of monetary support from central banks, there has been an increasing disconnection between financial markets and the real economy. This creates opportunities in various special situations strategies, such as corporate carve- outs, buy-and-builds, litigation funding or distressed investing.

As we move into 2021, investors look for ways to put their capital to work in quality assets and growing companies that are less prone to market volatility. They recognise that private equity strategies are likely on the verge of an attractive vintage, as with previous crisis vintages of the early 2000’s or following the great financial crisis of 2008.

We expect that 2021 will see a greater volume of transactions as economies recover and businesses’ run rates normalize.

A selective and patient approach is fundamental. Investors need to be sure that they are not ‘catching a falling knife.’ The retail industry, to take one example, is going through a major-transformation that will have an irreversible impact while also creating new opportunities in technology, turnaround businesses and logistics. We concentrate on structural growth opportunities and continue to like

healthcare, technology and software-enabled business services. We also look at sectors such as leisure, which are facing short-term challenges. They allow investors to take advantage of good entry points in solid companies with compelling, long-term customer demand.

More than ever, investors have to take a close look at the solidity of balance sheets as the pandemic has revealed the inadequate capital structures and excess leverage underlying many companies. The other issue that investors have to watch carefully is governance and ESG (Environmental, Social and Governance). This is an increasingly important factor in decision making for investors including SYZ, but also a clear performance driver. Moreover, what may look at first glance like a cheap opportunity may turn out to be the leader in a technologically-superseded, dinosaur industry.

Building a diversified private equity allocation demands discipline, deploying regular commitments across a number of years. As history shows, a crisis would be the worst time to stop investing. On the contrary this is when investors can often capture the most rewarding opportunities. Private market investors have a unique opportunity to take advantage of the current stressed environment through strategies such as special situations and secondaries, and secure attractive entry levels in well-managed companies that will survive headwinds and emerge stronger than ever. Viewed from this perspective, 2020/21 may yet prove to be a very rewarding year.

A favorable trading environment

- The hedge fund industry looks far more mature than it did 12 years ago. This recession, the first in decades that does not trace its origins to the finance industry, is proof of that. Alternative funds are less leveraged, have diversified their counterparties more efficiently, and for the most part, have managed to recover their losses from the early part of the year.

The levels of fiscal support injected this year into economies by governments and monetary aid from central banks have reduced the risk of corporate defaults for now. While that continues, plenty of ‘zombie’ firms have been saved that would otherwise have collapsed. Still, those hedge funds that have put in place solid fundamentals and have the tools to continue their work, are generating, and can continue to generate strong performance, even in this low- rate environment.

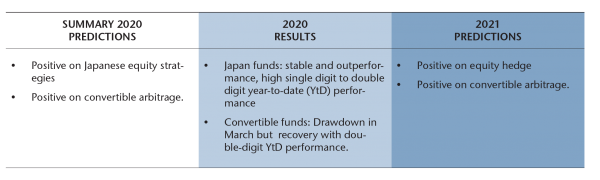

We currently favor equity hedge strategies where, since March, volatility has decreased and remains at healthy trading levels. In China, ‘A’ shares are driven by retail investors which bring more opportunities for alpha generation while a similar situation has developed in the US this year. Even Japan, which has been difficult to trade in recent decades, offers interesting opportunities thanks to the corporate governance improvements implemented under former Prime Minister Shinzo Abe. Equity long/short managers are also well positioned to identify winners and losers as we look ahead to the post-Covid-19 world.

Finally, convertible arbitrage funds are working well in the current environment benefitting from higher volatility and a high level of issuance, which corporations have almost doubled in 2020. We believe that the benefits of convertibles described above mean that these strategies can play an important role in almost every client portfolio.

For the rest of this year, the volatility in markets, despite the divisive US election result, should not be as problematic as in March 2020 when markets were grappling with unknowns around economic lockdowns. These are sectors where there are clear winners, and alternative instruments should continue to apply their market understanding to prove their value across portfolios in a challenging year ahead.