This transition is, in many ways, very welcome as it reflects the gradual normalization of economic activity across developed economies. Of course, the virus is still with us and continues to take its toll. New and highly contagious variants will probably remain a threat for some time, but vaccine rollouts have helped governments to progressively lift Covid-related restrictions and the spectre of large-scale lockdowns has receded. The private sector is progressively resuming growth, with employment and investment spending on the rise. In parallel, government crisis support is being gradually phased out after successfully smoothing the pandemic’s economic impact, and central banks are looking at winding-down their record liquidity injections.

From Recovery to Steady Growth

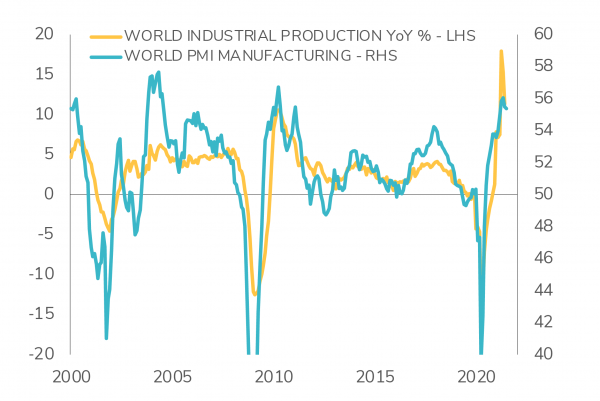

Monday, 09/13/202118 months into the Covid pandemic, the world economy has experienced its shortest yet deepest recession ever, followed by one of the strongest recoveries on record, thanks to historic levels of government and central bank support. The magnitude of the shock, and the uncertainties around its impact on the economic outlook, meant financial markets oscillated between despair and hope, with occasional spikes in both directions. Europe’s summer marks another step in this atypical economic cycle with a transition from recovery to an environment of steadier growth.

For most businesses and households, these developments and the prospect of normalizing economic growth conditions are encouraging. However, for financial markets this transition from recovery to more steady growth can be a source of heightened volatility.

First, the prospect of diminishing support from governments and central banks raises concerns about the economy’s ability to keep itself going. Withdrawing support too soon risks damaging today’s positive dynamic. Second, the transition from ‘recovery’ to ‘steady growth’ means switching from fast and spectacular improvements with low expectations, to less spectacular and less linear rates of growth. While the absolute economic situation is clearly better in a growth rather than a recovery phase, the balance of financial market risks does then tend to shift.

After positive revisions to GDP and better prospects for earnings growth over the past year, the risks of a disappointment now outweigh the chances of better-than- expected news. The central scenario of continuing growth with a benign withdrawal of central bank and government interventions still supports risk appetite.

Solid earnings growth remains a strong catalyst for equity markets. But, as economic conditions gradually normalize, companies with good balance sheets and visibility on their earnings prospects are likely to regain their leadership positions, at the expense of cyclical sectors that have most benefited from the recovery.

In portfolios, we believe that it therefore makes sense to continue taking profits on the cyclical exposures built since the end of 2020, at both the sectorial level (financials, materials) and regional allocations (emerging market equities). This is because softer global economic growth momentum and US monetary policy normalization will create a less favourable environment for these investments.

In parallel, opportunities may appear in fixed income. The credit spread widening in Asia over the past few months offers an attractive entry point into an asset class offering sound yields, especially compared with investment grade credit and even US and European high yield credit. Even exposure to long-term government rates can now add some value, as they offer diversification and a portfolio cushion should we experience an increase in equity market volatility. The ‘steady growth’ phase that the global economy is entering therefore warrants keeping a constructive portfolio bias, essentially through equity exposure. It also requires adjusting this exposure toward secular trends of quality growth stocks and long-term bonds, after the reflation phase and the cyclical leadership that we saw in the first half of this year.

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document. (13)