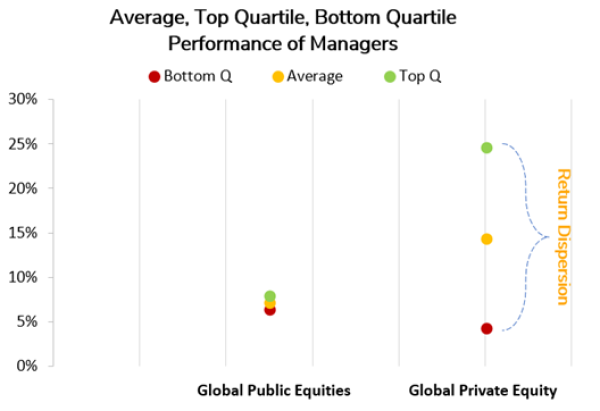

Factors contributing to return dispersion

Several factors affect return dispersion in Private Equity, emphasizing the importance of manager selection. The following highlights the most critical aspects to consider.

Sourcing, execution and value creation

A Private Equity manager’s ability to source and execute deals are prime factors in determining the fund’s ability to demonstrate superior performance. After acquiring a company, managers’ active ownership and contribution to strategic initiatives may generate higher performance.

Entry valuation

The entry valuation at which investments are made is one of the most relevant factors in determining the risk-return profile of Private Equity deals. Managers who can negotiate favorable entry valuations are more likely to realize superior returns, thereby contributing to the outsized return potential. Moreover, acquiring companies at low entry prices can significantly limit the potential for losses, thus reducing risk.

Inefficient pricing

Illiquidity in Private Equity investments can lead to higher return dispersion due to information asymmetry and, thus, inefficient pricing. Leveraging deep market insight is therefore key to ensure superior outcomes.

Time horizon

Private Equity investments require a longer-term horizon to realize potential gains. If a manager leverages the value creation opportunities within the holding period, substantial returns can be achieved. Conversely, an extended investment horizon without creating value can negatively impact returns.

Use of leverage

The use of leverage can amplify both returns and losses, thus contributing to return dispersion. Skillful management of leverage is therefore critical in Private Equity.

Company size

Large companies with established operations and consistent performance are less likely to underperform or fail. On the other hand, the potential to generate value, and thus higher returns, in a smaller company is greater due to the large untapped growth potential.