Syz Capital Themis

Hera Law Firm Lending

The Hera law firm lending platform ("Hera") is a private debt investment program through which Syz Capital seeks to offer access to a diversified portfolio of loans originated by non-bank lenders with a focus on the legal service sector.

Through rigorous diligence and credit monitoring, Hera offers a private debt alternative with a relatively short duration, low correlation and downside protection achieved via conservative loan-to-values, strong security packages and guarantees.

The facilities are senior secured, full recourse loans to establish law firms primarily involved in representing plaintiffs in mass tort litigation, which for regulatory and structural reasons are undeserved by the traditional banking and direct lending industry.

Syz Capital SPMO

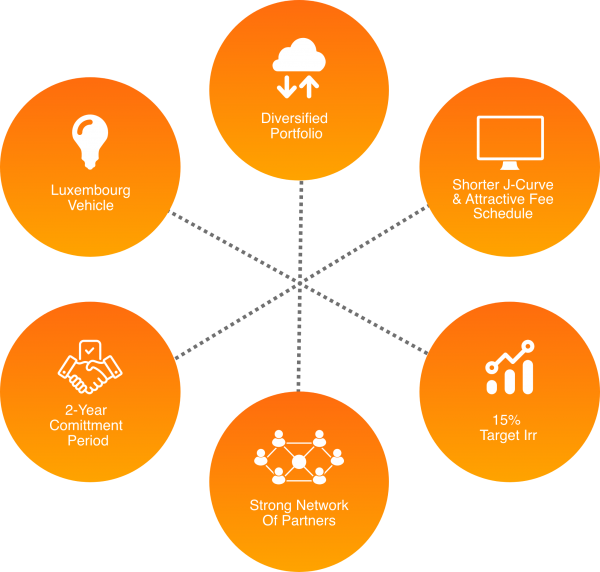

Syz Private Market Opportunities is a private investment partnership established to invest in a diversified selection of high return private equity transactions and strategies, alongside specialized teams in their core areas of expertise.

With a focus on developed markets of Western Europe and North America, the strategy invests in niche sectors and companies exhibiting strong business models, attractive valuations and achievable value creation plan, leading to asymmetric target return profiles.

The portfolio spans lower mid-market buyouts, growth investments including buy and builds, late stage venture investments, and some distressed opportunities. It is complemented by select co-investments, discounted secondary transactions with short path to exit, and uncorrelated special situations.

Syz Capital ECHO

European Continental Hotel Opportunities fund invests in hotels, which are in leading European tourist destinations that have a hotel supply shortage, due to regulatory, demographic or permit reasons. These cities are well connected via international airports that can cater to and sustain the influx of inbound tourists.

We have identified that these cities lack the hotel capacity to fill the growing levels of tourist activity, especially over the next coming years. This results in higher occupancy and higher room rates, leading to higher rental income.

The strategy operates in a segment, which lacks competition from a target acquisition and return perspective.

ECHO focuses on situations that are too long for developers (12-24 months) and too short for long-term investors, which have 20-year contracts.

Syz Capital Uncorrelated

Syz Capital Uncorrelated is a unique absolute return all-weather strategy, looking for low correlation to traditional asset, and at the same time providing consistent returns.

By allocating mainly to relative value and macro strategies, the fund aims to have a low beta to equity and bond markets and so, is resilient to their sell-offs. The research of alpha is the key element of this strategy.

Syz Capital Equity Hedge

Syz Capital Equity Hedge is an absolute return strategy looking for equity market performance with lower volatility. The fund is mainly allocated into diverse equity strategies: Equity long/short, event-driven and equity relative value.

Learn more about our work and arrange a meeting.